Contents

Share

Energy efficiency has boosted its way to becoming a top priority in today’s real estate market. Buyers and renters are actively looking for homes that are both cost-effective, and environmentally conscious. This is where the Energy Performance Certificate (EPC) comes into play and becomes absolutely essential. A property’s EPC rating not only impacts its attractiveness but also plays a significant role in its value and marketability.

What Is an Energy Performance Certificate (EPC)?

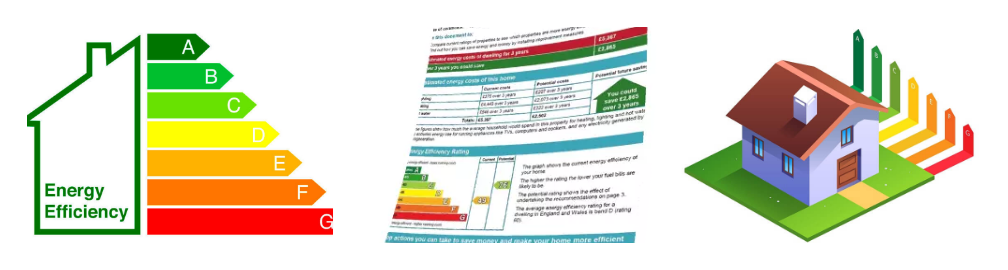

An Energy Performance Certificate (EPC) is a document that digs deeps, and rates a property’s energy efficiency. It gives potential buyers and tenants a detailed understanding of the building’s energy utility, likely running costs they’d have to incur, and the environmental impact the running of the household is likely to have. Properties are graded on a scale from A, being the most efficient to G, being the least efficient, with higher-rated homes typically being more attractive due to lower energy bills.

As an estate agent, making sure that a property has a valid EPC is absolutely necessary for compliance. Since 2007, it has been a legal requirement for all properties being sold or rented to have an EPC in place. Failure to provide one can result in fines and potential delays in transactions.

Beyond compliance, an EPC can be a valuable marketing tool. Properties with higher energy ratings often appeal more to buyers and tenants who prioritise cost efficiency and sustainability. Additionally, the EPC includes recommendations for improving energy performance, which can help sellers and landlords enhance their property’s appeal and value.

To streamline the process, estate agents should always verify that an EPC is available before listing a property and guide sellers or landlords on obtaining one if needed.

Estate agents can conveniently access EPC related services with PropertyBox. With PropertyBox, you can check the validity of an existing EPC, or even order a new one. Interested? Learn more here!

How EPC Ratings Affect Property Value

A higher EPC rating can significantly enhance a property’s value, making it more appealing to buyers and tenants. Studies show that energy-efficient homes often sell for higher prices and are in greater demand. Here’s why:

1. Lower Energy Bills – Homes with better insulation, modern heating systems, and energy-efficient lighting consume less electricity and gas, leading to significantly lower utility bills. Buyers recognise these savings as a long-term financial benefit, making them more inclined to invest in a property with a strong EPC rating. For landlords, energy-efficient rentals may also command higher rents, as tenants value reduced household expenses.

2. Increased Demand – Sustainability and eco-conscious living are becoming key factors for homebuyers. Properties with high EPC ratings (A or B) stand out in listings and attract more interest from buyers who prioritise energy efficiency. Additionally, governments and local councils are pushing for stricter energy efficiency regulations, meaning homes with poor EPC ratings could face decreased demand or require costly upgrades before being sold or rented.

3. Mortgage and Lending Benefits – Many mortgage lenders now offer green mortgages or preferential rates for homes with high EPC ratings, as energy-efficient properties are seen as lower-risk investments. Buyers purchasing homes with an EPC rating of C or above may qualify for lower interest rates or cashback incentives, making these properties more financially attractive. As a result, sellers with higher EPC-rated homes can use this as a key selling point to justify a higher asking price.

Key Factors Influencing Marketability:

To sum it up, the key factors that influence the marketability are;

1. Government Regulations – The UK government has set a minimum rating of E for rental properties. Properties below this threshold cannot be legally rented out unless exemptions apply.

2. Eco-Conscious Buyers – Like we said, numerous buyers and investors now factor in sustainability when making property decisions.

3. Potential for Upgrades – Homes with lower ratings might require costly upgrades, deterring potential buyers.

How to Improve Your Rating

If you want to boost your property’s EPC rating, consider these energy-efficient improvements:

1. Upgrade Insulation – Loft, wall, and floor insulation can greatly reduce heat loss.

2. Install Energy-Efficient Windows – Double or triple glazing improves insulation and reduces energy bills.

3. Switch to LED Lighting – A simple yet effective way to improve efficiency.

4. Invest in Renewable Energy – Solar panels or heat pumps can significantly enhance a property’s rating.

How to Find Your EPC and Order a New One

If you’re unsure of your property’s Energy Performance Certificate (EPC) status, the first step is to check if a valid certificate already exists. In the UK, you can do this by searching the official EPC register using your property’s address. If the EPC is expired or unavailable, you’ll need to order a new one.

To obtain a new EPC, a qualified Domestic Energy Assessor (DEA) must conduct an assessment of your property. This involves evaluating insulation, heating systems, windows, and overall energy efficiency. The assessor will then issue a certificate with an energy rating from A to G, along with recommendations for improvement.

For estate agents and landlords, ensuring a valid EPC is in place is essential before marketing a property. Services like PropertyBox simplify this process by allowing you to quickly check an existing EPC or order a new one – helping you stay compliant while making your listings more attractive to buyers and tenants.

Ready to check or update your EPC? Get started with PropertyBox today!

Conclusion

An Energy Performance Certificate (EPC) is more than just a legal requirement – it directly impacts a property’s value, marketability, and appeal. A high EPC rating can increase property prices, attract more buyers or tenants, and ensure compliance with regulations. For homeowners and landlords, improving energy efficiency isn’t just good for the environment, it’s a smart financial move!